First Time Home Buyer 401k Withdrawal 2024 – However, the first-time home buyer tax credit expired in 2010. There has been talk in Congress of reinstating a similar home-purchase incentive, but to date, no new tax credit program for first . If you are a first-time home buyer in particular, you need to be equipped with the know-hows of how a home loan works in the current scenario. While the internet is already rife with plenty of guides .

First Time Home Buyer 401k Withdrawal 2024

Source : www.putnam.com

New 401(k) Contribution Limits for 2024 | 401ks | U.S. News

Source : money.usnews.com

401(k) Contribution Limits In 2023 And 2024 | Bankrate

Source : www.bankrate.com

Read This Before Draining Your 401K to Buy Your San Diego Home in

Source : www.sandiegorealestatehunter.com

Hannah Rein, CPA | Financially Engaged® (@financiallyengaged

Source : www.instagram.com

IRA Required Minimum Distributions Table 2023 2024 | Bankrate

Source : www.bankrate.com

6 Things to Know About Roth 401(k) Withdrawals | The Motley Fool

Source : www.fool.com

Timely Topics — Gilbert & Cook

Source : www.gilbertcook.com

New 401(k) and IRA Contribution Limits for 2024 Articles

Source : www.consumerscu.org

Van Beek & Co., LLC | Tigard OR

Source : www.facebook.com

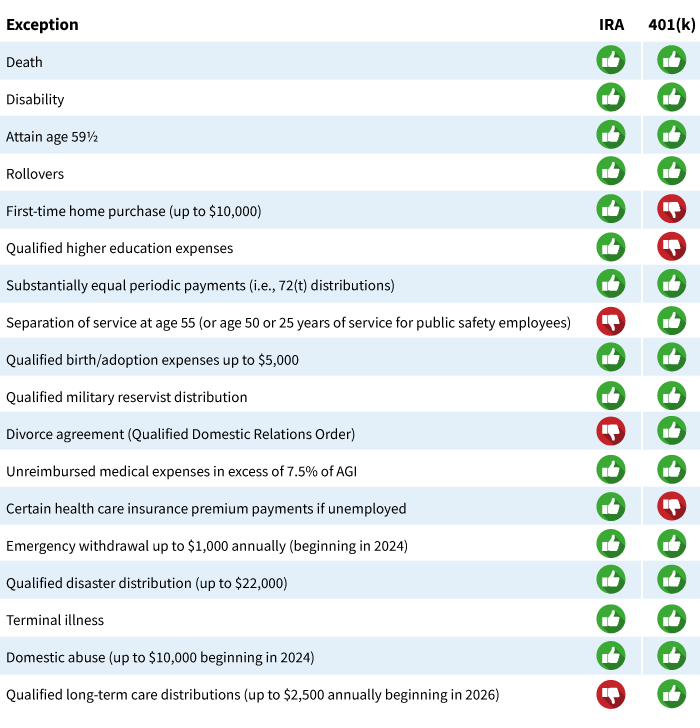

First Time Home Buyer 401k Withdrawal 2024 Tracking ways to avoid withdrawal penalties from retirement accounts: Good thing you’re a first-time home buyer. No, really. For one thing, current market conditions are keeping possible repeat buyers on the sidelines. A Zillow report says current homeowners with . Filing your income tax return is the first step to qualify for any benefits, credits or other tax incentives like the ones for housing. The HBP could allow you to withdraw up to $35,000 from your .